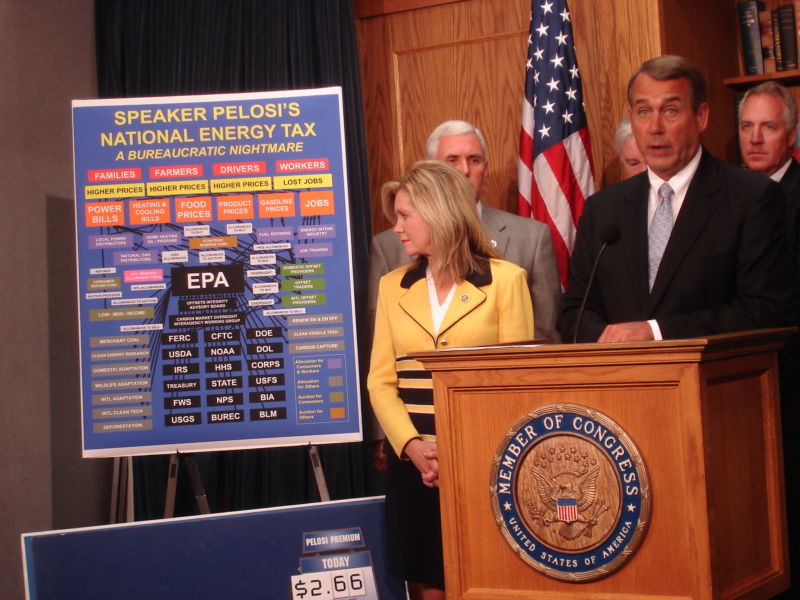

/ Home Republicans hold an interview opposing part of the Waxman-Markey Costs with the assistance of a chart representing … something.

.

Lobbying is seemingly a method to notify political leaders about concerns impacting their constituents. However it has likewise end up being a market of its own as those with a monetary interest in legislation vie to sway choices in their favor. Windows into the lobbying world are restricted in the United States, however needed public reporting can a minimum of make it possible for a postmortem of the actions related to significant expenses.

In the very first 2 years of the Obama administration, health care legislation was not the only weighty proposition rattling around in Congress. The Waxman-Markey Costs extremely almost resulted in a nationwide cap-and-trade system for greenhouse gas emissions. It would have developed a continuously diminishing cap on nationwide emissions, with tradable authorizations needed for substantial emitters. It was expected to have bipartisan appeal, including a market-based system instead of an easy tax or required. However while it passed your home of Representatives, it never ever accomplished the filibuster-proof assistance in the Senate required to see a vote on the flooring.

University of California, Santa Barbara, scientist Kyle Meng and the University of Chicago’s Ashwin Rode set out to examine the function of lobbying because failure. What makes this so tough is the reality that public records of who invested just how much on lobbying do not inform you whether they lobbied for or versus the costs.

So the scientists got innovative.

Analyzing lobbying

Openly traded business that lobbied represented 86 percent of the $725 million invested in lobbying. Meng and Rode tracked their stock costs throughout the costs’s argument; this basically let the marketplace suggest whether each business was anticipated to benefit or lose cash under cap and trade. To make this work, they likewise required another market: a forecast market.

Betters on the website Intrade purchased agreements that would pay if the Waxman-Markey Costs was gone by completion of 2010, with differing agreement costs driven by the political weaves along the method. By comparing these 2 markets, the scientists might determine which business saw stock costs drop when the forecast market increased– this was an indication that financiers hesitated the cap-and-trade costs would pass and cut into the business’s revenues.

With lobbying expenses now designated to the 2 sides, you can start to break things down. For beginners, there was a connection in between just how much a business might be anticipated to gain/lose if the costs passed (based upon stock habits) and just how much it invested in lobbying. However if you try to find that connection on each side individually, you get a somewhat various slope to the lines– business with the most to get in fact invested more than business with the most to lose. (And in basic, more business that were anticipated to get lobbied.)

Obviously, the costs didn’t pass, so the business anticipated to get didn’t get what they desired. Simply put, their lobbying expenses might be thought about less reliable. To measure this, the scientists utilized a mathematical game-theory design that determined the cost/benefit curves for lobbying. That design reveals that you ‘d anticipate lessening returns on lobbying– the very first million dollars invested is a little bit more impactful than the next million dollars invested, and so on. That is particularly real for the business that anticipated to get if their lobbying was less reliable.

Regional lobbying, international expense

Reserving the other political aspects, this design likewise computes the possibility of the costs’s passage based upon the lobbying on either side. The design approximated that the balance of the lobbying minimized the costs’s opportunities by 13 percent.

Because warding off greenhouse gas emissions decreases has an effect on everybody, the scientists likewise approximately approximate the international expense of this lobbying. Utilizing conservative numbers for the money worth of the emissions that would have been prevented through 2050 under the costs, they put the expense of lowering its possibility of passage by 13 percent at $60 billion.

The design likewise permitted the scientists to do another thing: see if changing the costs might have altered lobbying habits in such a way that may have assisted it pass. Part of setting up a cap-and-trade system is dispersing the preliminary emissions allows. Even if the general emissions cap is set in stone, you still need to find out how to divvy up that cap.

The most reliable method of changing this ended up being targeting the business that just stood to lose a little. Handing them a couple of more authorizations might turn them into the “anticipated to get” classification, altering the side they lobbied on. And if the very first lobbying dollars are the most impactful, that’s a significant swing. While there are lots of factors one might challenge dispersing authorizations in this method, this is one method you might reduce resistance to a costs of this kind.

The scientists likewise acknowledge that lobbying is just part of the story. Occasions like the death of Sen. Ted Kennedy (D-Mass.) and the increase of the Tea ceremony motion contributed, and the political calculus can depend upon a selection of aspects. And, obviously, these lobbying records reveal absolutely nothing of the cash invested outside the halls of Congress to sway popular opinion or back election efforts. Still, there’s some worth in getting a peek at part of the device.

Nature Environment Modification,2019 DOI: 101038/ s41558-019-0489 -6( About DOIs).