It utilized to be that start-up creators normally didn’t attempt to personally money in their stakes in their business up until they had actually at least gone public or been gotten.

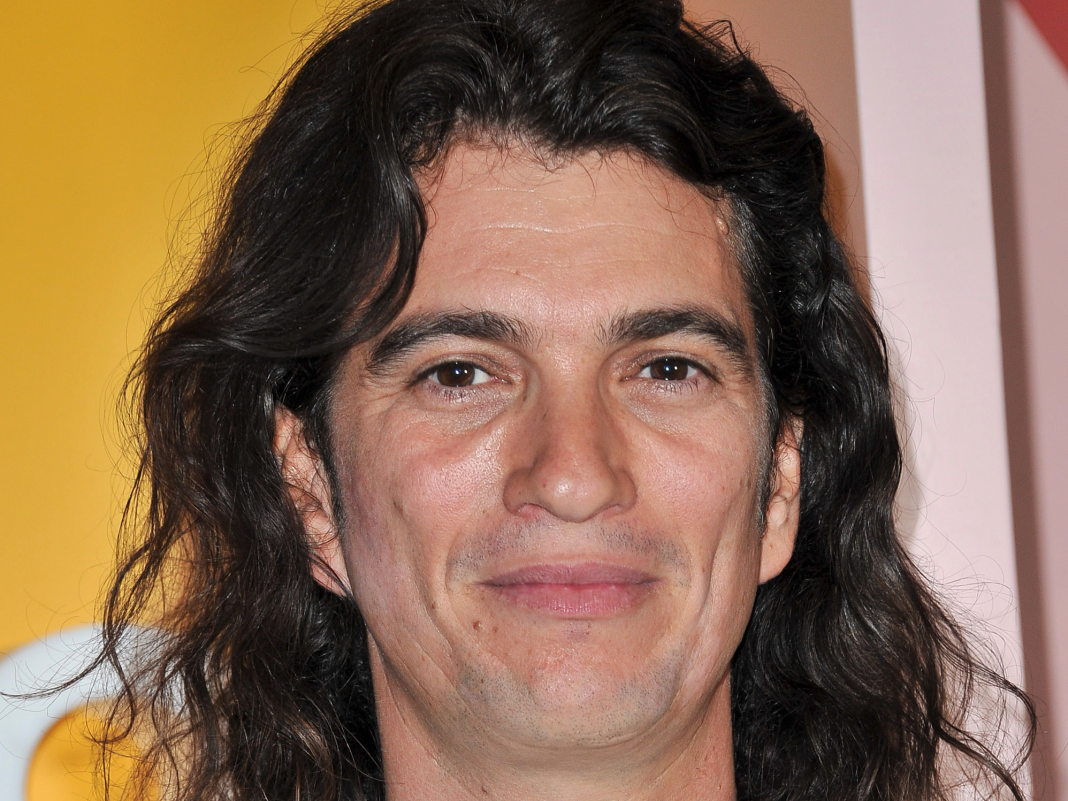

As WeWork CEO Adam Neumann has actually shown– to the tune of $700 million, according to a report by the Wall Street Journal on Thursday— that standard is altering. And you can associate that shift to the huge increase of capital into the endeavor markets and particularly into business such as WeWork.

“Generally, it would be unusual for this to occur,” stated Charlie Plauche, a partner with Austin, Texas-based S3 Ventures. “However generally, business didn’t raise this lots of billions in dollars of rounds of financing prior to an IPO.”

The taboo on creators moneying in prior to their business went public was rooted in desire to guarantee that creators were totally purchased the long-lasting success of their start-ups and not simply attempting to make a fast dollar. However the basic restriction on such relocations has actually slowly been raising, and the practice of creators selling parts of their stakes for their own advantage while their business are still personal has ending up being more typical, particularly considering that the last monetary crisis.

More creators are moneying in, however Neumann stands apart

Zynga creator Marc Pincus, for instance, offered $109 million worth of his business’s stock in a pre-IPO deal in2011 Evan Spiegel and his cofounders of Snap each moneyed in $10 million worth of their stakes in 2013, 4 years prior to the business’s IPO. And Uber’s Travis Kalanick offered a 29% of his stake in the app-based ride-hailing business in 2018, after he had actually been ousted as CEO however prior to the business went public.

Neumann’s deals, however, stick out for their cumulative size, especially for a creator who stays his start-up’s CEO. As the Journal reported, WeWork’s Neumann has actually personally amassed some $700 million from a mix of offering his shares in the business and getting loans from it that are backed by a few of his staying shares.

“The magnitude of Neumann’s sales is a severe outlier,” stated Jay Ritter, a financing teacher at the University of Florida who carefully tracks the IPO market.

It’s difficult to figure out without more information on the deals simply just how much of his stake Neumann offered in the relocations. That’s since they happened over the last 5 years, according to the report, and WeWork’s appraisal has actually skyrocketed over that time– going from $5 billion at the end of 2014 to $47 billion at the start of this year.

Neumann, through a WeWork agent, decreased to talk about the report or the deals to Company Expert.

The increase of endeavor loan is sustaining the pattern

Unlike creators in earlier periods, however like a growing number today, Neumann holds a managing stake in this business regardless of not owning a bulk of its shares. He has the ability to do that since the shares he does own get 10 votes each, while other shares just get one vote, as The Journal reported. That control suggests, normally, that he can run the business as he pleases and does not need to fret as much as another creator may about whether his financiers authorize of his stock sales. Pincus, Spiegel, and Kalanick remained in comparable positions.

However the size of Neumann’s sales is likewise a function of the worth of his business. Which in turn is connected to a huge increase in late-stage capital. Companies such as Softbank have actually been purchasing up stakes in older, more fully grown start-ups. That loan– Softbank alone has actually been investing out of its massive $100 billion Vision Fund— has actually enabled those business to remain personal longer.

That pattern, however, has actually likewise assisted to move mindsets about creators moneying in a few of their stakes early, endeavor financiers stated.

In previous times, prior to the increase of late-stage capital, business of the age and maturity of WeWork would have currently been public. Creators regularly offer parts of their stakes in an IPO; it utilized to be the very first time that a number of them got to see a windfall from the success of their business. Financiers have actually concerned see relocations such as Neumann’s in a comparable light, Plauche stated. Had actually WeWork been public by now– as generally it would have been– he would have had the ability to money in anyhow.

“In later phase business, where the creator has actually postponed liquidity occasions for several years and the appraisal has actually grown, the squander make a lot more sense,” Plauche stated.

Financiers are in fact motivating it, sometimes

Another, associated consider the increase of such squander is that they typically are the only method for late-stage financiers to get the stake they prefer in a specific business, financiers stated. In a few of the more fully grown start-ups, the business itself does not always require anymore money or the existing financiers do not wish to additional dilute their stakes by having it provide brand-new shares. So the brand-new financiers themselves might motivate creators and early staff members to offer their shares in secondary markets.

“There’s simply increasingly more late-stage financiers seeking to put loan to work,” Pauche stated, “and eventually, the only method to do that is to offer liquidity to existing holders than put loan on the balance sheet.”

However the pattern is moving beyond simply more fully grown start-ups to those that are previously in their advancement, stated Kristian Andersen, a partner with High Alpha, an Indianapolis-based endeavor studio. Financiers have actually concerned think, from observing the growing variety of squander at more fully grown start-ups, that there isn’t as much threat as they might have formerly believed in such relocations, he stated. And in fact the start-ups might gain from creators taking a little off the table, he stated.

New creators at later phase business tend to have a substantial quantity of wealth secured in their shares. Concerned that they might lose it all if they mess things up, they can end up being mindful, Andersen stated. Permitting them to money in a few of their stakes prior to an exit can assist them be a little bit more unwinded and more concentrated on the business’s future beyond an IPO, he stated. He still disapproves creators at truly early phase business attempting to money in. However for those at business that are even more along– ones in their series B financing rounds and beyond– he believes it’s completely great.

“Progressively, you’re seeing early-stage financiers not just being comfy with it, however oftentimes motivating it,” Andersen stated. He continued: “We have actually motivated a number of our CEOs to take a couple of chips off table as they take their trip up.”

Still, there are genuine factors to fret if and as the pattern ends up being more widespread. In many cases, a creator selling early can be an indication of an uncertainty in the business or even worse. In 2000, for instance, Nina Edge offered the majority of her stake in her start-up, World Online, a couple of months prior to its going public at a portion of its IPO cost. The business’s stock cost plunged right after its IPO, and the business was offered months later on.

Got a pointer about a start-up or the endeavor market? Contact this press reporter by means of e-mail at twolverton@businessinsider.com, message him on Twitter @troywolv, or send him a safe message through Signal at 415.5155594 You can likewise contact Company Expert firmly by means of SecureDrop